What is SaverLearning?

Eden Conway

Eden Conway

What is SaverLearning and who is it for?

SaverLearning is launching in Q1 2024 and we at Saver.Global wanted to give you a clear overview of what it is and who it’s for.

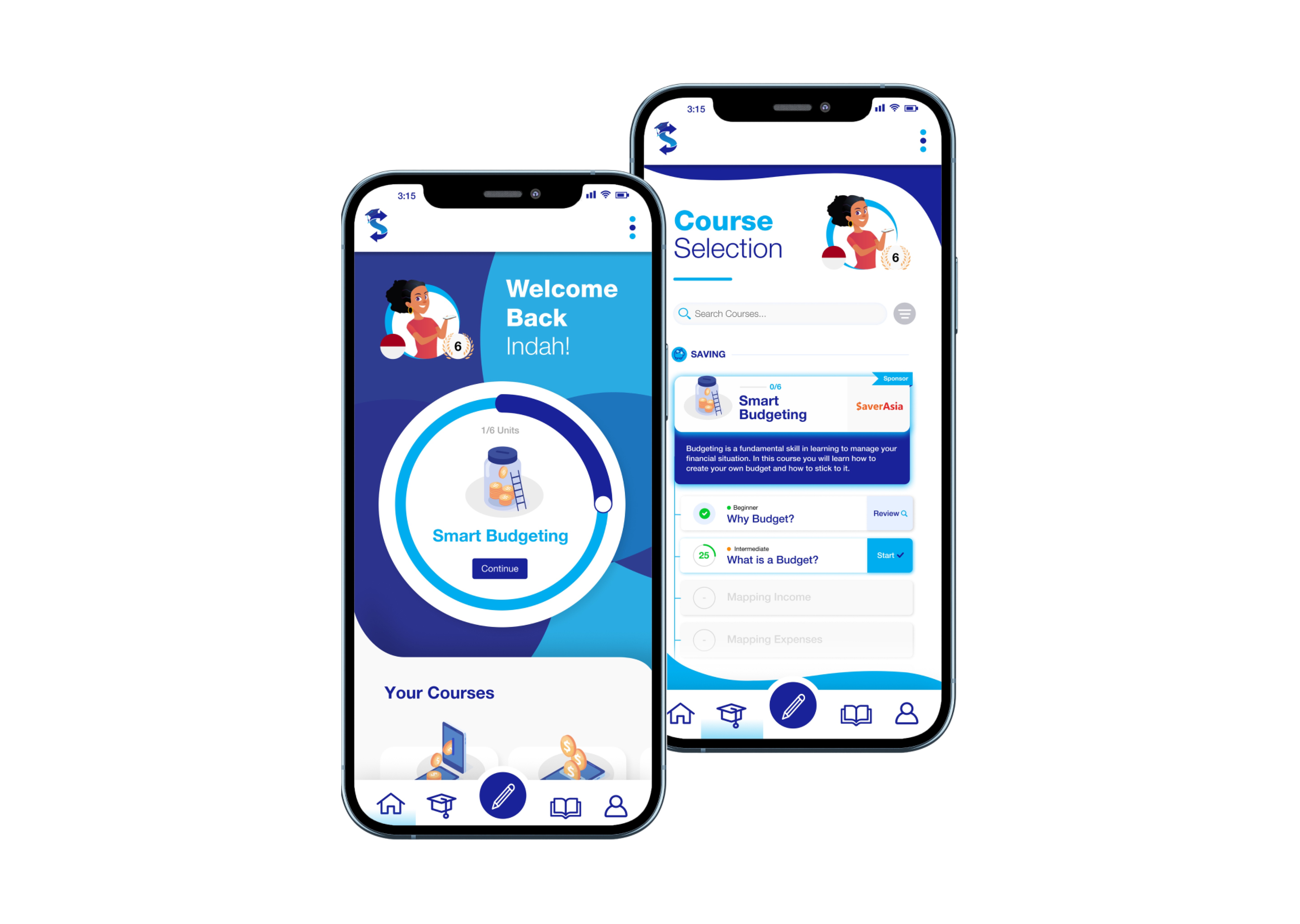

What is SaverLearning?

SaverLearning is a financial education app. It makes learning about finance easy and rewarding.

How does it work?

SaverLearning delivers content through courses, tools, and games that help people engage with their finances and realise the potential of financial mastery.

Courses

Individuals can access courses on a range of topics, starting with the basics of budgeting and moving to specifics like making an international money transfer. These courses teach the personal finance fundamentals behind financial products so that people can make an informed decision about which service will be best for them. Three courses will be available upon release:

- Smart Budgeting

- Banking Basics

- Making the most of your remittances

There will be new courses being released every month, so keep an eye out. Soon, courses presented in partnership from well-known organisations will be appearing on the app.

Tools

We have found that the most effective way to teach financial literacy is by helping people envision their future. By using tools like calculators and planners, the learner can see the effect of financial decisions on their life. Rather than learn through lectures or readings they can learn in bite-sized pieces of information and apply what they’ve learnt directly into the way that they manage their finances.

Gamified

The learning process involves activities and case studies that challenge learners to use their financial knowledge in real-life situations. These are designed to be fun (and often funny) ways to explore the impact of decisions about money.

Rewards

As someone progresses through the app and completes courses, they will unlock rewards with real life organisations. These include discounts or promotional offers with different providers that are relevant to the courses they have completed. More rewards are being added each month, so don’t forget to check back in the future.

Who is it for?

SaverLearning is for everyone! Personal finance is a lifelong skill and nearly everyone has more that they can learn. Currently, the courses are targeted towards those who are starting to take control of their finances for the first time or those who want to learn more about banking across borders. This means that we are perfect for young people or people who have recently moved to Australia. As we continue to add courses, we are confident that everyone will be able to find valuable lessons no matter their current level of understanding.

Our Model

Saver.Global, the company behind SaverLearning has a long history of working with partners to develop and deliver financial education courses in the Pacific and Southeast Asia. Scaling these initiatives is precisely why SaverLearning was developed. Saver.Global wanted to take the learnings from in-person courses and develop a tool that can be used by millions around the globe. Thus, Saver.Global continues to work with partner institutions to design, develop, and disseminate courses.

Eden Conway

Eden brings both humanitarian and development experience into the Saver.Global strategy. He builds on our ability to revolutionise international development in his role as General Manager, Operations.