Future Proofing Migrant Workers with the Tools to Enhance Lifelong Financial Goals

Robyn Kingston

Robyn Kingston

Future Proofing Migrant Workers with the Tools to Enhance Lifelong Financial Goals

Knowledge and education are key to empowering migrant workers with the ability to create successful outcomes for a sustainable financial future following work placements overseas. It should not go unrecognised the immense personal sacrifice migrant workers make when they take up labour migration opportunities. Travelling far away from families for months on end to provide a better future does not come without consideration to the worker and their family’s welfare. Leaving behind children, partners and wider family in search of being able to provide a more secure financial future, it is certainly not a decision taken lightly and not one everyone is willing to make.

There are plenty of well-organised labour migration schemes around the world and many of them provide workers with pre-departure training on a variety of aspects, including financial management. The workers’ welfare and personal success is just as important a consideration for the labour mobility schemes as is the profitability for employers and the sending and host country’s economic development. As with everything, some schemes are more advanced in their astuteness offering guidance and training schemes to workers to ensure their personal success. Financial literacy included in such training programmes can be provided by a range of organisations from governments, financial institutions, private companies and larger intergovernmental organisations. Saver.Global understands how vital clear, simple to use training tools are to educate workers effectively at a time when they are possibly feeling overwhelmed with the prospect of their journey ahead, new environments and culture changes for the duration of their work placement.

In the Pacific region, two of the most notable labour migration schemes are the Pacific Australia Labour Mobility (PALM) scheme in Australia and Recognised Seasonal Employers (RSE) in New Zealand which employ Pacific workers largely in the horticulture and agriculture industries, and some placements within the meat industry and viticulture (and also in Australia, aged care and hospitality). Across these schemes there is no universal training for workers departing from the Pacific Islands, although each Pacific country offers a pre-departure programme, the specific training content and subjects covered varies significantly. This blog explores some of the trialed examples and pilot programmes helping workers to maximise the financial gains from their temporary migration.

ANZ MoneyMinded programme worked with Fijian RSE workers in the 2019-20 season and set out to explore how by providing financial management training to workers prior to starting RSE work placements, it could enhance their future financial wellbeing on their return to Fiji. The training commenced in Fiji with pre-departure sessions covering topics such as budgeting, remittances, savings, ANZ apps and online banking. The training was delivered in face-to-face training sessions and also initiated the application process for these workers in opening ANZ bank accounts. The application process was managed through ANZ Fiji and the opening of accounts was completed by ANZ branches in New Zealand upon workers’ arrival. Rabih Yazbek, Country Head of ANZ Fiji says in the forward of the MoneyMinded Impact Report (2022) “Overall, we’ve seen Fijian seasonal workers who completed MoneyMinded start planning and saving money and setting goals for a sustainable financial future.” which is an admirable outcome from the programme. The report goes on to state that 96 percent of participants felt more in control of their finances at the end of their training, compared to only 16 percent at the start of the programme.

The Australia Pacific Training Coalition (APTC) offer a wide range of skills development courses across the Pacific Islands, and have also worked with Pacific Island governments supporting the regional labour mobility schemes. Specifically they partner with the Australian Pacific Labour Facility to offer pre-departure training for workers engaged on the PALM scheme, preparing participants with skills that may be required by Australian employers as well as essential skills in terms of workers’ financial management, health and wellbeing. This course is much broader than the ANZ MoneyMinded course but still aims to provide workers with essential future planning financial awareness.

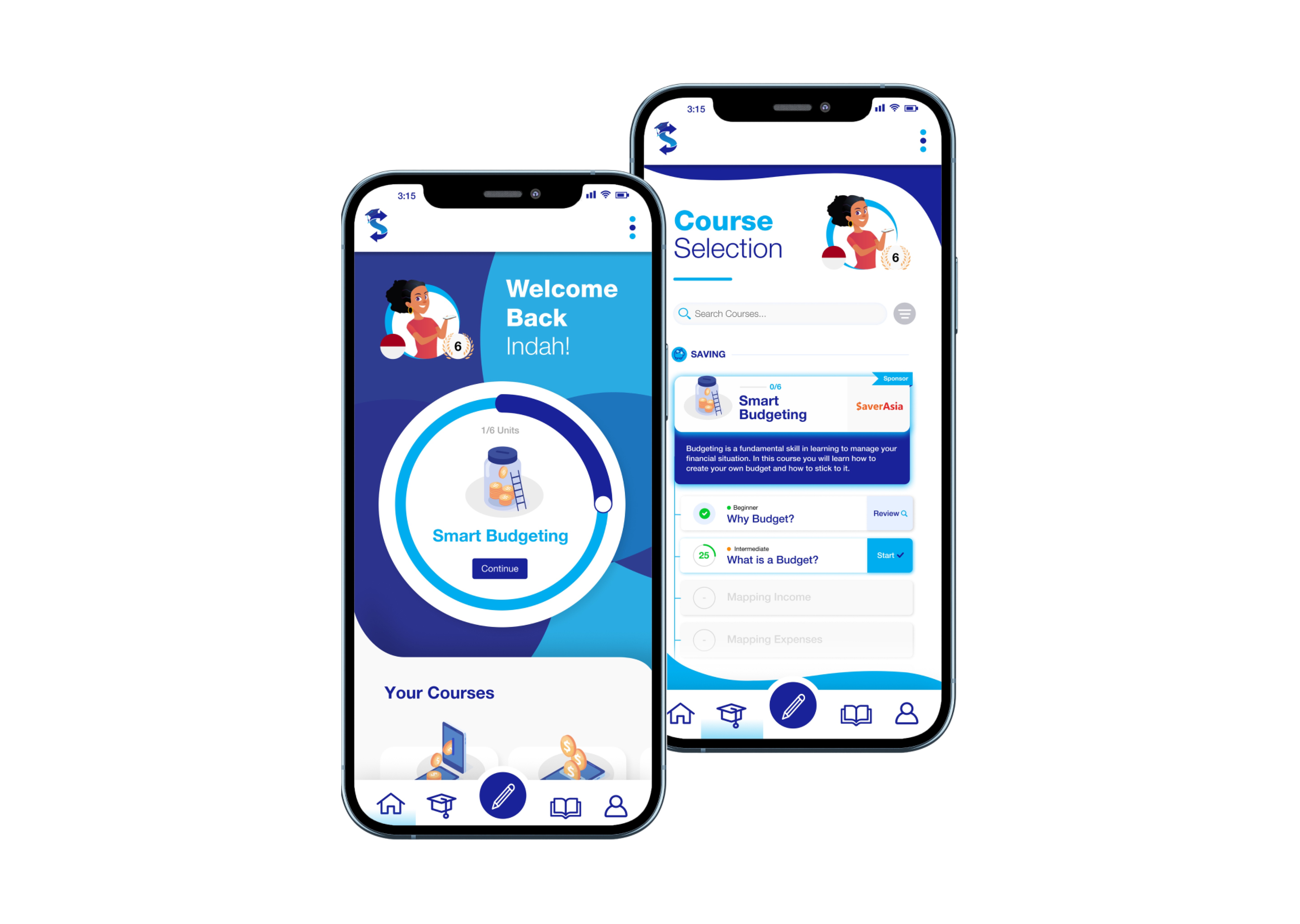

Soon to be launched, Saver.Global’s SaverLearning app hosts a suite of financial literacy courses tailoring the experience to the individual. Focused on financial literacy and inclusion, courses cover remittances for overseas workers, together with price comparison websites for users to find the most suitable service for their needs; budgeting courses and calculators to help users plan for their own circumstances. Courses are culturally relevant and available in multiple languages and as such are highly relevant for workers on labour migration programmes. Users are exposed to real time data and examples to show how best these tools can be used in their personal financial management.

These examples of well timed, appropriate financial management training programmes indicate the life changing impacts financial education can have on workers, their families and communities. The World Bank endorse financial literacy for future proofing workers financial future in recommendation 9 of the Maximising the Development Impacts from Temporary Migration report 2018: Provide tailored financial advice and savings options for Pacific seasonal workers upon return – where the detail states “… ensuring that they are fully informed and aware of all options at their disposal would provide a net benefit.”[1]

[1] World Bank. 2018. Maximizing the Development Impacts from Temporary Migration: Recommendations for Australia’s Seasonal Worker Programme.

This blog was written by Robyn Kingston, Labour Mobility Expert

Robyn Kingston

Robyn has 10+ years of experience within the remittances industry, including as Research and Data Lead, Asia-Pacific region at DMA Global, where she has worked on the World Bank’s Remittance Prices Worldwide project and SendMoneyPacific.