Beyond the Hype: Evolution towards a Cashless Society

Robyn Kingston

Robyn Kingston

Beyond the Hype: Evolution towards a Cashless Society

People often ask about the likelihood of our country becoming a cashless society in the near future. There is a lot written and discussed about this in our press but the fundamental answer right now is no, this will not happen imminently.

That said, Australia and New Zealand have some of the lowest levels of cash payments in the world. In 2023 both countries were among the top countries globally where cash accounted for less than 10 per cent of point of sale (POS) transaction value. This is compared to the global figure of 16 per cent of POS global transaction value in 2023 (an 8 per cent decrease from 2022). Yet, there are plenty of countries where cash is still widely used including Thailand and Japan where 46 per cent and 41 per cent respectively of POS transactions in 2023 were cash transactions. Currently, the most common payment method globally is through digital wallets, taking a 30 per cent share of the POS global transaction value. Debit and credit cards combined take on 50 per cent of POS transactions, and it should be noted that debit cards are often the source of funds for e-wallets.[1]

For a society to become 100 per cent cashless and to solely rely on electronic, or digital payments requires the entire population to have access to some form of digital financial services – which, at present, is not in place. Sweden is the closest country to becoming cashless with only 2 per cent of transactions in 2023 being in cash. While a cashless society for Sweden is in sight, Erik Thedéen, governor of the Riksbank (Sweden’s Central Bank) said earlier this year that payments must continue to work for everyone, cash must continue to be accepted and that the banks need to do more to ensure customers have access to accounts. [2]

Moving towards a cashless society involves a number of considerations. Opening a bank account is not an option for everyone, and neither does everyone want to hold a bank account. Restrictions imposed by banks providing citizens with even basic bank accounts can exclude some members of society from accessing these types of accounts, for example people with no permanent address, regular income or necessary identification documents. While non-bank financial inclusion is growing rapidly through FinTech and mobile money evolution, it is not yet at a point where it is available to include everyone.

Care needs to be taken in the growth of the non-bank financial services sector. All products must be vetted and approved by the national financial services authorities to protect consumers and give them the confidence that their money will be safe with their chosen financial services provider. There needs to be sufficient choice within the market to provide for people in all circumstances: those with bank accounts and those without; those with simple financial needs and for people who may require a wider breadth of services; people with irregular, low or no income; no proof of address or ID documentation.

Non-bank financial inclusion is also often dependent on reliable and consistent internet access, especially for FinTech financial products such as e-wallets. Access to such internet connections may be a problem in some locations, particularly rural, as well as for some members of society. Mobile money (provided by national mobile network operators) while offering basic low level financial accounts to customers are not yet available in every country, including Australia and New Zealand so this not a viable option for these citizens.

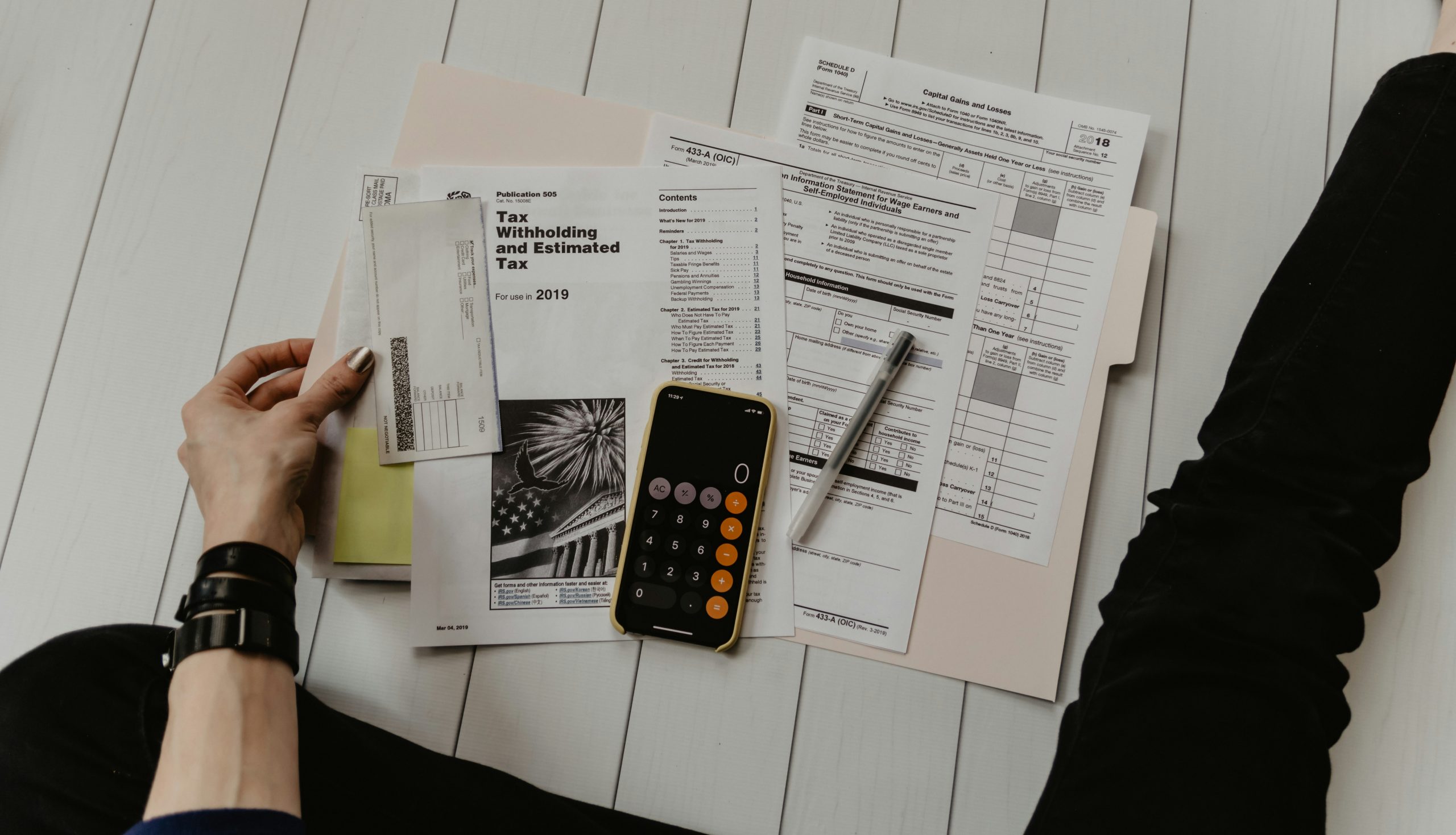

Then there is the privacy issue, using cash brings with it a right to confidentiality in how we chose to spend our money, there are many legitimate reasons why individuals may choose to use cash. Removing cash from society can potentially put some individuals at harm, people in abusive relationships may lose financial independence, people with physical or mental disabilities may find the concept of managing money electronically too difficult. Not all electronic payments currently debit or credit immediately from users accounts and this can make it more difficult for people to budget. It is far easier to budget when physically holding the cash and individuals can see the funds left in their hand. Likewise for joint or shared account holders where more than one person is spending from the account.

The banking industry itself is not yet ready for a cashless society. Without real-time processing where credits and debits are instantly available on customers’ accounts cash cannot be removed from society – private transactions and trades, for example, need to be validated before a transaction can take place. Citizens should be entitled to privacy in their lives and electronic money leaves a permanent digital trail. Security around identity theft and cyberattacks also needs to be watertight before cash can be removed from society.

There is no doubt that digital payments will continue to grow and that they will be adopted more and more by society, but there still remain essential hurdles to overcome before an entire nation can become truly cashless.

Article by Robyn Kingston, Labour Mobility Expert, writing from Aotearoa New Zealand

Image generated by ChatGPT.

[1] Data source: The Global Payments Report 2024 – Worldpay

[2] Source: Pymnts: Sweden’s Central Bank Proposes Rules to Facilitate Use of Cash

Robyn Kingston

Robyn has 10+ years of experience within the remittances industry, including as Research and Data Lead, Asia-Pacific region at DMA Global, where she has worked on the World Bank’s Remittance Prices Worldwide project and SendMoneyPacific.