Financial inclusion among labour mobility workers

Robyn Kingston

Robyn Kingston

Financial inclusion among labour mobility workers

Global financial inclusion has seen rapid growth over the ten year period from 2011 to 2021, the latest Findex report (2021) reported that across developing countries financial inclusion rates rose from 42 percent in 2011 to 71 percent in 2021. Much of this growth is attributed to the fintech explosion and the development of mobile and digital wallets reaching rural communities. Many countries worldwide now have a variety of options for adults to access and use some form of financial services within their home country. Yet despite the growth, 32 countries remain with financial inclusion rates below 50 percent. The lowest inclusion rate is seen in South Sudan where only 6 percent of the population are estimated to have a financial account. In fact, 19 of the 32 countries with under 50 percent financial inclusion rates are from the Middle East and African nations. The impact of Covid 19 and the necessity for contactless purchasing brought in a greater drive for the development of products and up take by the populations but other factors are also at play.

This blog looks at the current financial inclusion of labour mobility workers and their access to financial services during placements overseas. Labour mobility and the desire for workers to travel overseas for work brings with it a need for greater financial awareness and security while returning earnings and savings to family back home, without fear of theft or loss en route. The formalisation of labour mobility schemes globally and AML requirements means employers are more often paying wages directly into workers’ accounts, meaning workers employed from overseas will require local accounts for the duration of their work placement to receive their wages. For the worker themselves, their labour migration brings a flood of new experiences, for many it will be their first time travelling away from their family and home country. Understanding the financial landscape within their destination country, often a more developed country than their own, can be a daunting prospect.

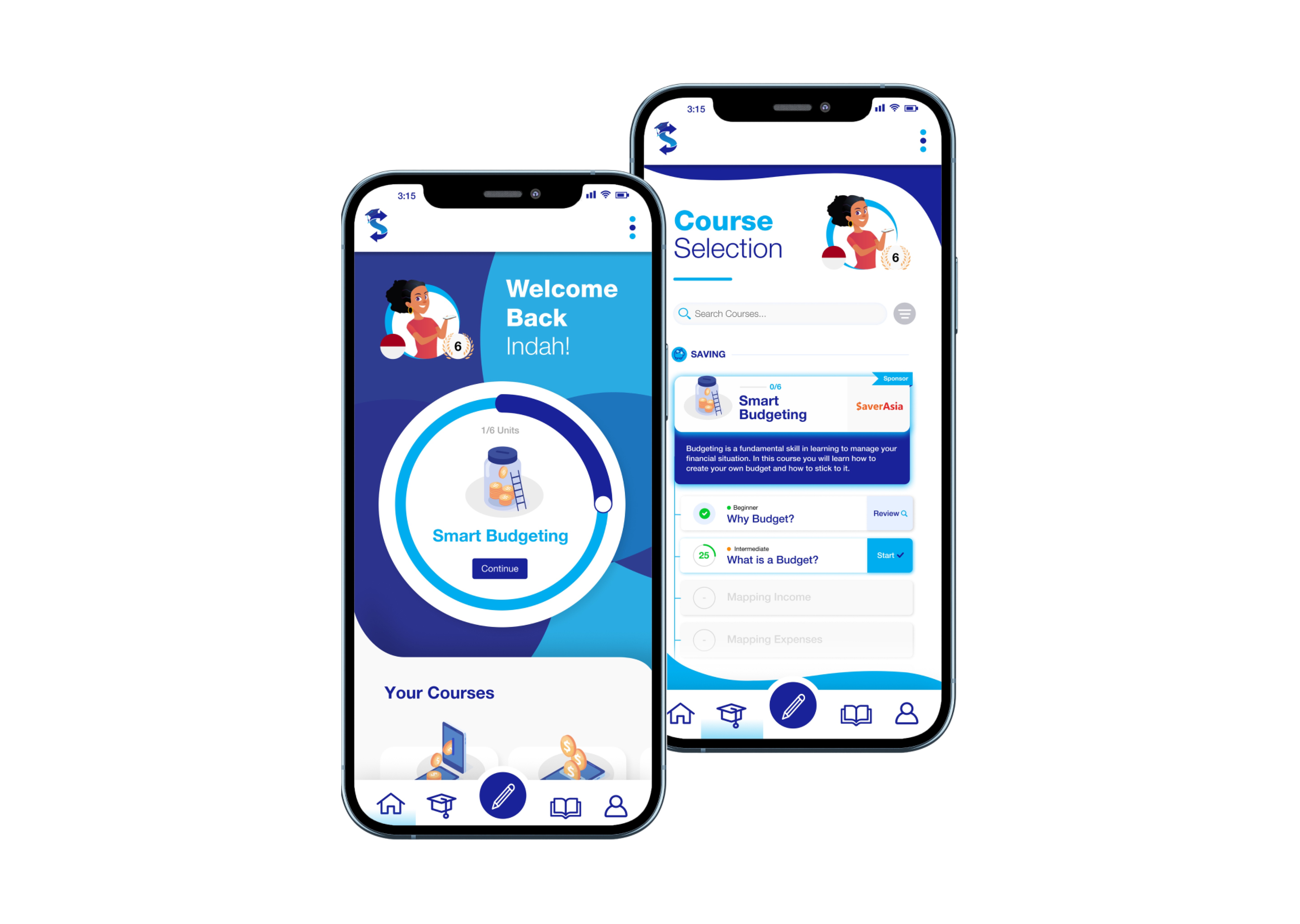

Including financial literacy as part of the pre-departure training process is key for migrating workers to maximise the benefits of their overseas work placement. Often workers will be travelling to a country where they do not speak the language so navigating financial services with which they are largely unfamiliar, and in a foreign language, can be a stressful and confusing process. Saver.Global and other international agencies such as the International Organisation for Migration (IOM) have developed simple courses which deliver key messages at a level pitched for the migrating worker. These are available on free to access apps and focus on the services most likely to be needed by the worker – basic accounts; savings; budgeting; and remittances (how the worker transfers their money home to families). The short courses are filled with images and simple to use processes to also take account of potential lower digital and reading literacy levels. The courses are targeted at specific migration corridors but are easily adaptable to other nationalities and are translated into the workers’ native language to ensure maximum reach and impact for the intended workers.

Benefits of the labour mobility schemes for the workers should not only be viewed through the fiscal gains of employment but also as a learning exercise for the workers in how to manage their finances. Helping to educate workers on how they can make their money work for them. The impact of labour migration on each worker is immense, the precious time spent away from their families must nurture their whole economic condition. Education which focuses on setting financial goals and making plans, including savings and retirement (financial management for life) is an important step to helping families of the migrant workers build security into the future. Encouraging entrepreneurial ventures on returning home not only helps to set up workers and their families, it also contributes to the economic development of their home country. It is through this full circle of labour migration, together with the right financial education that countries on both sides of the corridor develop economically. From the life and security of the individual worker to the economic development of their home nation.

Article written by Robyn Kingston, Pacific Labour Mobility Expert

Robyn Kingston

Robyn has 10+ years of experience within the remittances industry, including as Research and Data Lead, Asia-Pacific region at DMA Global, where she has worked on the World Bank’s Remittance Prices Worldwide project and SendMoneyPacific.