We deliver

Financial education with digital scalability

Saver.Global is a result of a shared vision between remittance industry experts and an innovative digital agency. With a combined total of more than 60 years’ experience in the industry, consulting on labour mobility programs and writing financial literacy curricula, the team have built an exceptional online service that helps migrants (and everyone!) save time, save money and save for their future.

Our vision

To unlock the benefits of new financial technology for those who need it.

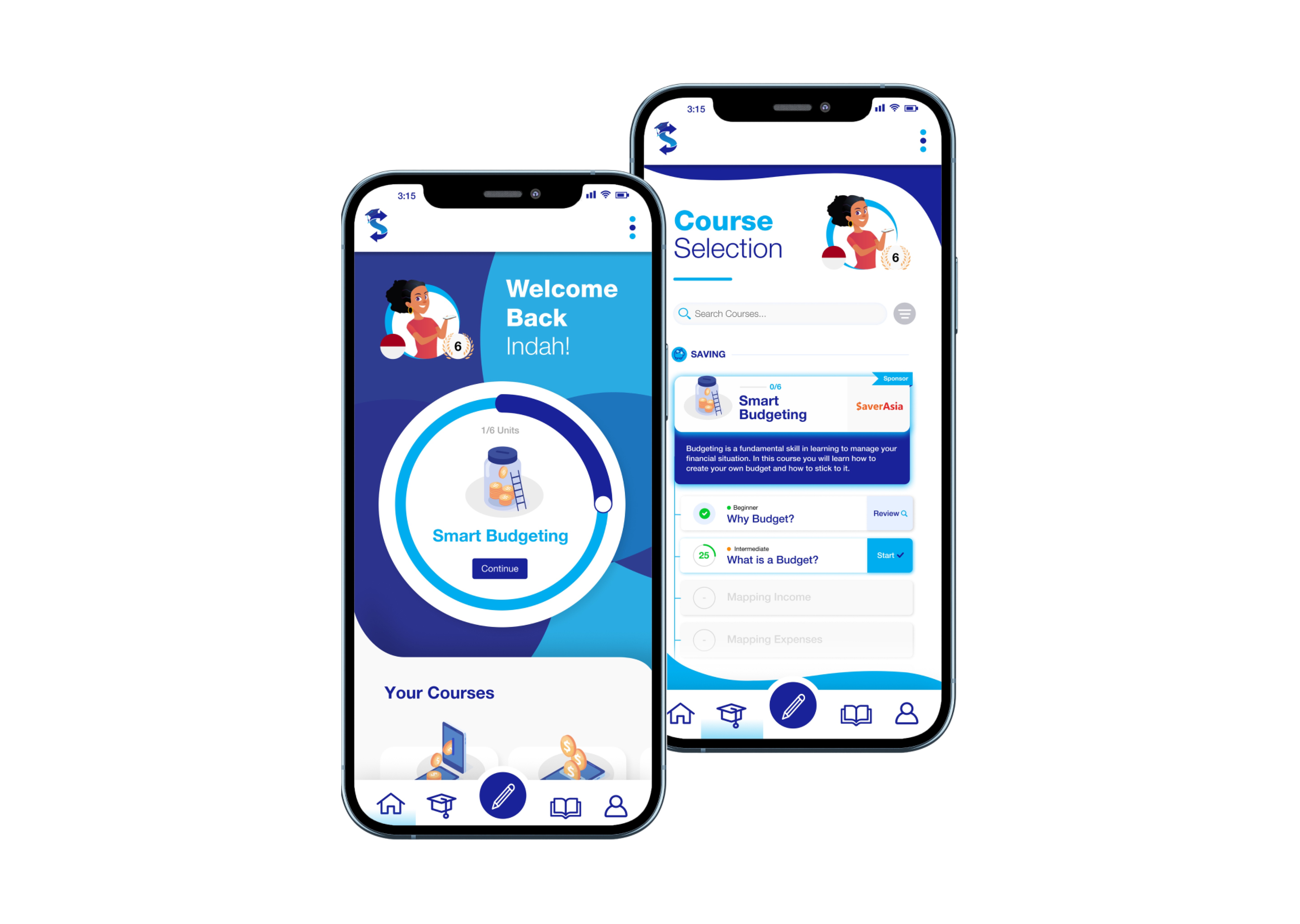

Online financial education platforms

Online financial education platforms

Free-to-use services that empower individuals

Free-to-use services that empower individuals

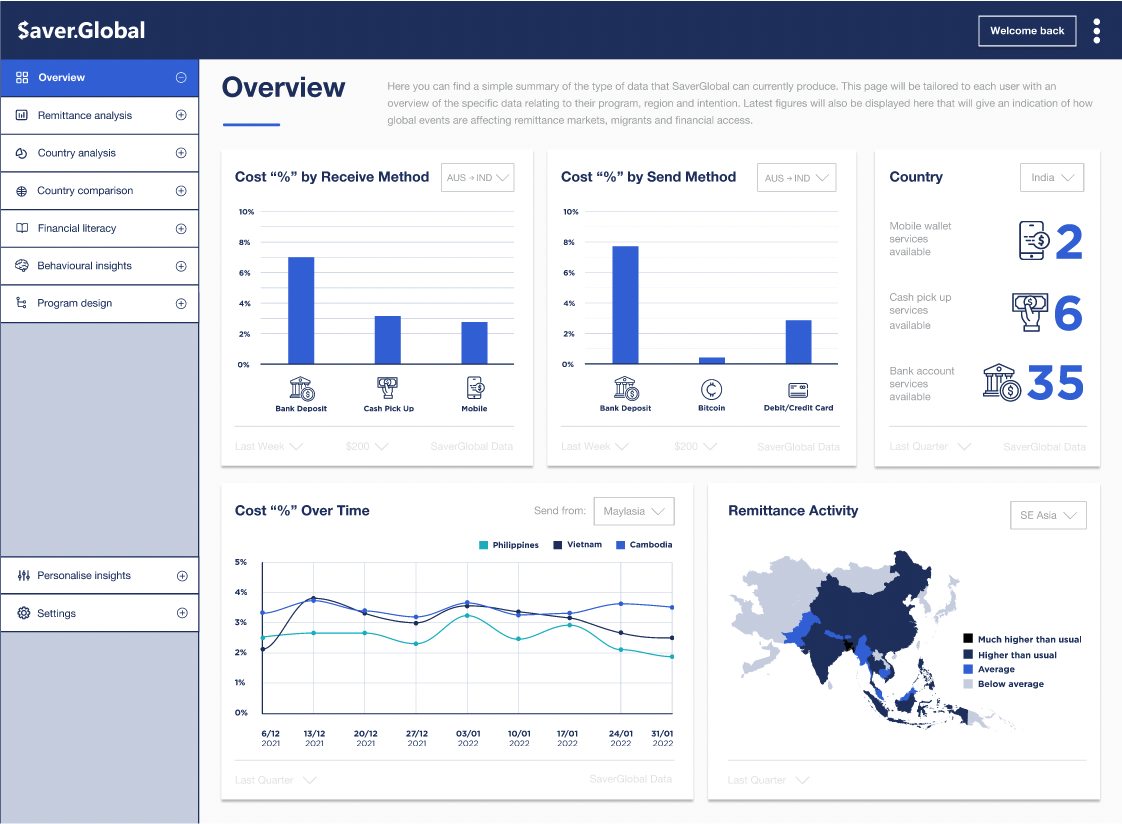

Real-time financial service and pricing data

Real-time financial service and pricing data

Accessible and multilingual design

Accessible and multilingual design

Monitoring and evaluation dashboards for development programs

Monitoring and evaluation dashboards for development programs

Our impact

Sustainable Development Goals

Our work in remittances, financial literacy, and labour migration contribute tangibly towards several United Nations SDG 2030 targets.

SDG 10 - Reduced inequalities

“By 2030, reduce to less than 3 per cent the transaction costs of migrant remittances and eliminate remittance corridors with costs higher than 5 per cent”

Saver.Global is revolutionising this sustainable development goal by making low cost services accessible for the migrant worker community. Transaction costs listed on Saver platforms range from 1.8% to 15% with the top services averaging 2.1%.

SDG 4 - Quality education

“Ensure inclusive and quality education for all and promote lifelong learning”

Saver.Global is committed to making remittance sending more accessible to migrants and reducing their cost. This is key to empowering remittance receiving households. Children from remittance families, especially girls, register higher school attendance, enrolment rates and additional years in school.

SDG 5 - Gender equality

“Equal rights to economic resources, property ownership and financial services”

Women now comprise half of all remittance senders, totalling 100 million. Remittances transform the economic role of women on both the send and receive side enabling financial independence and better employment opportunities. Saver.Global is committed to including women in the financial empowerment of the migrant community.

SDG 8 - Decent work / economic growth

“Promote inclusive and sustainable economic growth, employment and decent work for all”

By working closely with the ILO and IOM, Saver.Global promotes the benefits of remittances for migrant workers. By reducing average remittance costs to 3 per cent globally, remittance families would save an additional US$20 billion annually. Substantially increasing disposal income for remittance receiving families and helping transform remittance receiving communities.

SDG 17 - Partnerships for the goals

“Mobilize financial resources for developing countries”

Saver.Global along with the international community seeks to leverage the development impact of remittances. More than 70 countries rely on remittances for more than 4 per cent of the GDP. The impact of remittances have a ripple effect through receiving communities and economies.

Our platforms

Transparent money transfer comparison tools

Six regional platforms delivering a tailored migrant experience. Each offering a money transfer comparison service empowering families to save time and money together with financial resources, education and tools.