How financial literacy improves migrant lives, businesses and the economy

Malorie Anne Manaois

Malorie Anne Manaois

How financial literacy improves migrant lives, businesses and the economy

With increasingly complex financial products available, understanding basic financial concepts enable people to make informed financial decisions that maximise the benefits they realise. However, the current state of financial literacy levels across the globe indicates significant room for improvement that both governments and non-governmental organisations can step in to support.

How financially literate are we?

According to the S&P’s Global Financial Literacy Survey, [1] the top 10 countries had 63% of their representative populations assessed to be financially literate. Almost 90% of these countries are from developed and advanced economies, mainly from Western Europe and Oceania. In contrast majority of the world’s population appear to only have 31% to 40% of financially literate adults.

In North America, there is a distinct disparity among Mexico (32%) and its northern neighbours such as United States (58%) and Canada (68%). The difference significantly widens further in South American countries where no countries had more than 50% of financially literate adults. Majority of Latin America ranged between 21% to 30%.

Though Western Europe and its Scandinavian countries appear to be highly literate, the rest of Europe has a spread of literacy levels. Majority of the Eastern Bloc, however, did not score over 50%. In line with an apparent trend in southern regions having worse literacy levels than their northern counterparts, the African continent fell between 31% to 40%.

With the exception of 52% in Botswana, the poor financial literacy levels in this region comes as no surprise.

Asia and the Middle East are largely similar to Africa, wherein a significant portion fall between 21% to 30%. This is to be expected with larger populations in China (28%) and South-East Asia where financial literacy tools are not as readily available. However, advanced economies such as Singapore (59%) and interestingly Myanmar (52%) are among few that have scored above 50%.[2]

These varying levels of financial literacy, especially the lower levels in the origin countries of most migrant diasporas, present the significant need for education and financial empowerment to support the progress and advancement of these countries.

The missing link in migrant success

In a migrant context, financial literacy can aid migrants to identify opportunities to save money by comparing optimal exchange rates and fees they can send or receive money with.

With decreasing fees from the digitisation of money transfers and pressures for traditional money transfer operators to comply and adapt, to competitors and the UN, migrants are now empowered more than ever . However, there is still a slower than desired uptake on these digital services as migrants struggle with the perceived complexity of these products.

Financially literate migrants are more likely to strategically plan for their household goals, such as the purchase of a family home.[3] This requires a level of understanding regarding savings and credit, which most migrants may lack. Preventing them from effectively advising their families back home to manage remittances they send. A lack of financial literacy prevents potential savings for future investments that can support the return and/or retirement of the migrant to their origin country.

Those with greater knowledge of financial literacy are able to adequately prepare for their return, or the consequent migration of their family overseas. Though the latter requires an understanding of immigration laws and protocols, a degree of budgeting and cost-benefit analysis is still involved in making these decisions. The financially educated are more likely to consider these options possible than those that need more education and are more likely to believe they must be a migrant forever.

Consequently, families of the financially literate migrant are more likely to enjoy a comfortable lifestyle than the financially illiterate. For the migrants’ labour to be optimised, receiving families will also need a heightened degree of basic financial understanding. Thus, it is important the financial literacy support is available to both audiences—migrants overseas and families that live locally.

One of the greater challenges in promoting the importance of financial literacy is that the costs attributed to a lack of this knowledge still require a degree of understanding by the less literate. Costs of financial ignorance (lack of financial literacy) such as a disregard for transaction fees that can lead to greater debt, higher interest, and thus possible debt trap may be harder to process for those that have limited knowledge of credit, let alone the concept of compounding interest.[4] A two-pronged approach to financial education is therefore important, wherein both benefits and costs are highlighted to audiences once the foundational concepts have been covered.

Transforming businesses and the economy

Financial literacy levels are often linked with the GDP per capita and poverty levels. The S&P survey was able to find that higher per capita GDP has high correlation with higher financial literacy levels. This exemplifies that financially literate individuals are able to use this knowledge in savings, investing, borrowing and managing their finances, which consequently help businesses and their economies.

Better financial literacy leads to better choices for consumers, which can drive businesses such as money transfer operators to innovate their services. This can be seen in the average transaction fees from traditional operators of around 6% to the digital remittance costs from fintech providers that are currently as little as 2% to 3%. More market entrants are introducing new technologies to leverage the increasingly digital landscape of remittances and access to mobile wallets across the globe.

These combined improvements in responsible financial behaviour of migrants and innovation of businesses result in better economic development overall. As household savings and effective use of credit increases with financial literacy, economic activity can be boosted by the choices made by migrants to purchase a home, car, travel or other products available in an informed manner. Effective market economies are driven by financially literate populations that can balance risk-adjusted returns that lead to efficient allocation of resources and higher growth in the long-term.[5]

Empowering through education

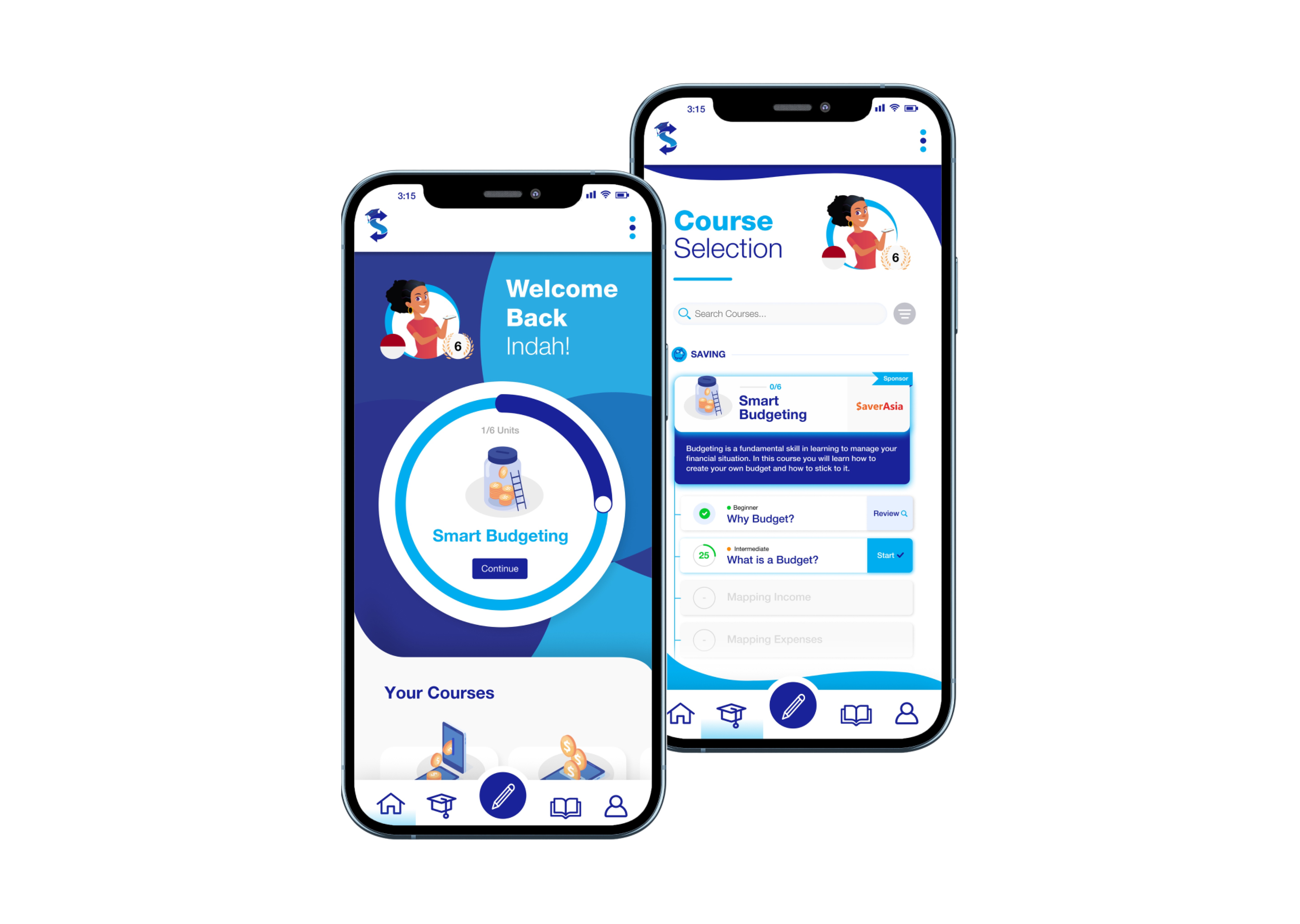

Many policy recommendations and frameworks have been provided and implemented by governments and other organisations around the world to uplift financial literacy. SaverRemit is among the few organisations that provide opportunities for partnerships with financial services and development agencies to develop migrant focussed financial courses.

SaverRemit has developed personalised financial literacy courses that engage audiences through the SaverAsia, SaverPacifific, SaverAfrica and SaverAmericas platforms. These offer app-based learning with engaging content tailored to different countries. Alongside, financial literacy blogs, the SaverRemit platforms also feature ‘How-to’ guides that give people the confidence to send money, receive money, open bank accounts and more. Budgeting tools and overtime calculators developed by SaverRemit also equip migrants with tangible resources to apply the concepts they learn from the courses and the platforms.

SaverRemit seeks to further contribute to the achievement of the UN Sustainable Development Goals (SDG), particularly SDG 10 and 4, by making remittances more accessible to migrants to fund their families’ education as well as uplifting migrant financial literacy as well. With continued support and collaboration through strategic partnership, SaverRemit believes that financial literacy across the globe can lead to shared success amongst migrants, their families, businesses and economies alike.

[1] Klapper, L, Lusardi, A, van Oudheusden, P, 2014. ‘Financial Literacy Around the World: Insights from the S&P Global FinLit Survey’, S&P Global, < https://gflec.org/wp-content/uploads/2015/11/3313-Finlit_Report_FINAL-5.11.16.pdf?x28148>.

[2] Raul, 2018. ‘What is the Financial Literacy Rates Around the World?’, How Much, <https://howmuch.net/articles/financial-literacy-around-the-world>.

[3] Hall, K, 2008. ‘The Importance of Financial Literacy’, Reserve Bank of Australia, <https://www.rba.gov.au/publications/bulletin/2008/sep/pdf/bu-0908-3.pdf>

[4] Klapper, L, Lusardi, A, van Oudheusden, P, 2014. ‘Financial Literacy Around the World: Insights from the S&P Global FinLit Survey’, S&P Global, < https://gflec.org/wp-content/uploads/2015/11/3313-Finlit_Report_FINAL-5.11.16.pdf?x28148>.

[5] Ibid.

Malorie Anne Manaois

Malorie uses her experience in developing financial literacy programs to innovate and build new resources that empower the users of SaverRemit platforms.