Remittances remain steady during COVID-19 despite predicted sharp decline

Malorie Anne Manaois

Malorie Anne Manaois

Remittances remain steady during COVID-19 despite predicted sharp decline

The COVID-19 pandemic has caused significant distress to families and economies worldwide, including to migrants and their remittances. Given the job losses and high rates of unemployment due to this virus, the World Bank had initially predicted remittances to decline by 20 per cent in 2020. However, for most receiving regions, this prediction has been contradicted by either steady or increased volume of remittances. In October 2020, the World Bank revised its predictions to 7 percent in 2020 and 7 percent in 2021, a total decline of 14 percent as a result of COVID-19.

Though the onset of the pandemic earlier in March 2020 saw the remittance flows decline in line with the prediction, several countries eventually began to recover towards the second half of the year.

Resilient Remittances

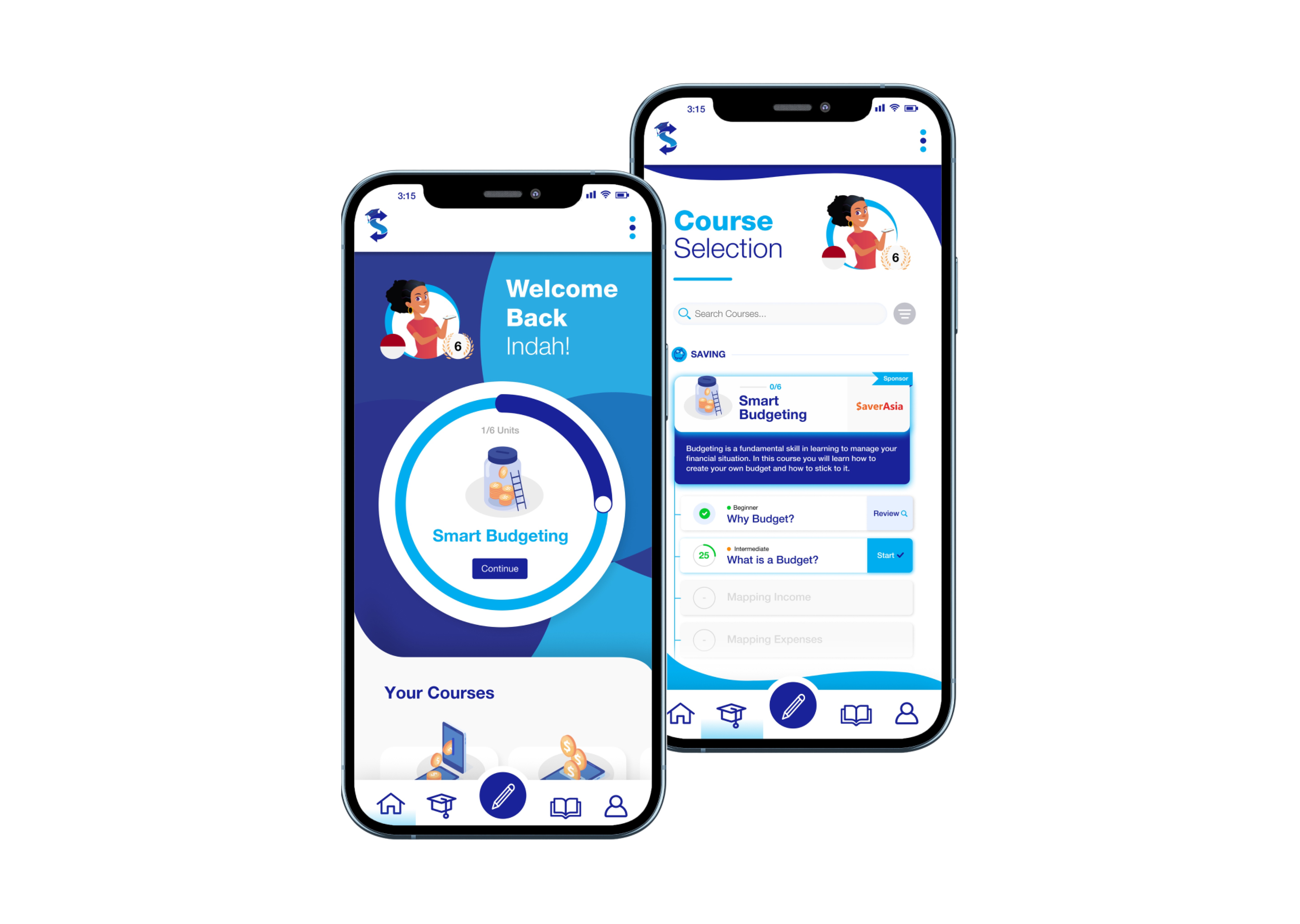

In the Philippines, where remittances account for almost 10% of their GDP (2019), remittances have remained steady and even increased year-on-year. October 2020 saw a 2.9 per cent growth in personal remittances to the country, which is expected to keep growing as the Christmas season approaches and the short-term appreciating trend of the PHP. The International Labour Organization (ILO), through its TRIANGLE in ASEAN programme, has supported the development of the SaverAsia app and website. www.saverasia.com is designed to help migrant workers from Asian countries such as the Philippines to compare the costs of sending remittances home, manage their money, and improve their financial literacy. Similarly, remittances to Mexico increased by 9.4% in the first eight months of 2020 and 400% in digital transfers to Fiji.

Remittances have been regarded as effective counter-cyclical measures that account for much of low-and-middle-income developing countries’ survival from economic downturn, more so than local economic stimulus from governments or foreign aid. Maintenance of these remittance levels despite economic difficulties in host countries is caused by several factors but are fundamentally attributed to strong family ties and altruism that propelled these migrants to pursue overseas work in the first place.

Why do migrants keep sending even in hard times?

Strong sentiments of pursuing a better life for their families back home push many migrants to keep remitting. The prominent mindset is that if they are struggling in their host country, their families in developing countries are experiencing much worse conditions. This thought process compels migrants to either send portions of their savings or increase their working hours to be able to send more.

Migrants in essential jobs, despite usually being low paying, may have also maintained a steady source of income, which has allowed them to continue sending remittances. Similarly, those in more established roles may have benefitted from support from their employment or those unemployed may have been eligible for stimulus packages. These can then increase their capacity to send money back home.

Previous financial crises have also generally fostered better money management amongst migrants, particularly in setting money aside for unforeseen circumstances. This has allowed migrants to ensure that both their needs in their host country and their recipients back home are met even in difficult times.

The fluctuations in exchange rates also plays a role into the sustained inflow of remittances. When there are devaluations in their home country’s currency due to greater economic distress in comparison to the sending country, the value of the money sent is inflated which benefits the migrant’s families. This was particularly seen in the case of Mexico at the start of the COVID-19 pandemic.

How can remittances continue its recovery?

As COVID-19 responses across the world continue and the number of cases improve, the recovery of level of remittances can be helped further by governments and other market players.

Governments in receiving countries could provide more support to the overseas workers that may require retraining to upskill and re-enter the workforce. The Australia Pacific Training Coalition (APTC) supported by the Australian Government, for example, has focused on delivering micro-credentials in digital skills and literacy to tourism workers that have lost their jobs. These micro-credentials are certified by TAFE Queensland, a recognised educational institution in Australia. Providing support to receiving families that have significantly suffered from a drop in remittances can prevent them from falling into poverty. Host countries can also continue efforts in providing access to health care and basic needs to migrants, particularly those that are undocumented.

Money transfer service providers have also been under pressure to reduce fees to make remittances cheaper for migrants. However, advancements in digital payment systems are of similar importance and benefit as this indirectly reduces the cost of transfers whilst increasing accessibility for migrants. By increasing efforts in providing digital options through mobile phone transfers or e-wallets, remittances may recover faster as senders and recipients no longer need to visit branches and could also compare rates online.

The importance of remittances underpins the significant contributions made by migrants to economies around the globe. Their efforts and hard work serve as a safety net and backbone for the crises that arise. Thus, ample support from governments and other market participants are much deserved by and owed to these hard workers in addition to their recognition every International Migrant’s Day.

By Malorie Manaois

Sources:

Aualiitia, T 2020, ‘COVID-19 leads to huge growth in digital money transgers to Pacific but concerns remains high over fees’, ABC, available at: https://www.abc.net.au/radio-australia/programs/pacificbeat/covid-significant-growth-in-pacific-digital-remittances/12731412.

Caron, L & Tiongson, E 2020, ‘Immigrants are still sending lots of money home despite the coronavirus job losses—for now’, The Conversation, available at: https://theconversation.com/immigrants-are-still-sending-lots-of-money-home-despite-the-coronavirus-job-losses-for-now-148387.

Cova, G 2020, ‘Remittances show promise in the face of the ongoing global COVID-19 pandemic’, Atlantic Council, available at: https://www.atlanticcouncil.org/blogs/new-atlanticist/remittances-show-promise-in-the-face-of-the-ongoing-global-covid-19-pandemic/.

Lopez, M 2020, ‘Remittances sustain growth to $3B in July despite pandemic’, CNN Philippines, available at: https://cnnphilippines.com/business/2020/9/15/Filipino-remittances-July-pandemic.html?fbclid=IwAR0ipZKoBiwOz2feGDMubocBJmRAAy3gpn9KOAAilByPIj74lQihS7JHQzg.

Mapa, N 2020, ‘Philippines: Remittances post another month of unexpected growth in October’, ING, available at: https://think.ing.com/snaps/philippines-remittances-post-another-month-of-unexpected-growth-in-october/.

Middleby, S & Nailatikau M 2020, ‘APTC and the pandemic’, Development Policy Centre, available at: https://devpolicy.org/aptc-and-the-pandemic-20200724/.

Quayyum, S N & Kpodar, R K 2020, ‘Supporting Migrants and Remittances as COVID-19 Rages On’, IMF Blog: Insights & Analysis on Economics & Finance, available at: https://blogs.imf.org/2020/09/11/supporting-migrants-and-remittances-as-covid-19-rages-on/.

Ratha, D; De, S; Kim, E J; Plaza, S; Seshan, G; & Yameogo, N D 2020, ‘Migration and Development Brief 32: COVID-19 Crisis through a Migration Lens’, KNOMAD-World Bank, Washington, DC. License: Creative Commons Attribution CC BY 3.0 IGO.

Sayeh, A & Chami R 2020, ‘Lifelines in Danger’, IMF Finance & Development, June 2020, Vol. 57, No. 2, available at: https://www.imf.org/external/pubs/ft/fandd/2020/06/COVID19-pandemic-impact-on-remittance-flows-sayeh.htm

Malorie Anne Manaois

Malorie uses her experience in developing financial literacy programs to innovate and build new resources that empower the users of SaverRemit platforms.