Simplifying a saturated remittance market

Malorie Anne Manaois

Malorie Anne Manaois

Simplifying a saturated remittance market

The remittances industry today

Over 1 billion people either rely on or send remittances (200 million migrant workers and 800 million family members). [1] Globally in 2020, $540 billion flowed into low- and middle-income countries. This makes up 75% of total remittance flows. This surpasses the sum of Foreign Direct Investment ($259 billion) and Overseas Development Assistance ($179 billion) into the same countries. [2] This market opportunity fuels the billion-dollar international money transfer industry that has been aggressively expanding due to financial technology start-ups (fintech) constantly entering the market.

Traditional money transfer operators (MTOs) that have remained expensive at 6.38% as of Q1 2021 are facing heavy competition from new fintech remittance providers offering low-cost services at 2-3%. Alongside bodies like the UN, Fintech’s leveraging purely digital business models have increased the pressures on large MTOs such as Western Union to reduce fees in line with the UN Sustainable Development Goals (SDGs). This is becoming apparent in the latest funding rounds and listings of several digital remittance providers in 2021 alone.

Wise, formerly known as TransferWise, is emerging as the largest fintech newcomer with the valuation of £9.3bn ($12.6bn) upon its listing on the UK stock exchange. This values Wise to be worth around one-third more than Western Union. [3] Following on Wise’s steps, Remitly is also aiming for a $6.5bn valuation from its IPO in September 2021. The Seattle-based fintech company’s last valuation was $1.5bn in July 2021. WorldRemit. [4] which has now rebranded to Zepz, is looking to go public soon after raising another $292m in a Series E funding round, valuing them at $5bn as of August 2021. [5] Singapore-based fintech, Lucy, have also raised $1m in a seed funding round to expand its app targeted at underbanked women. [6] These reflect the increasing investor interest in the growth potential of digital remittances, which is likely to continue to accelerate during and after the Covid-19 pandemic.

Global problem with regional solutions

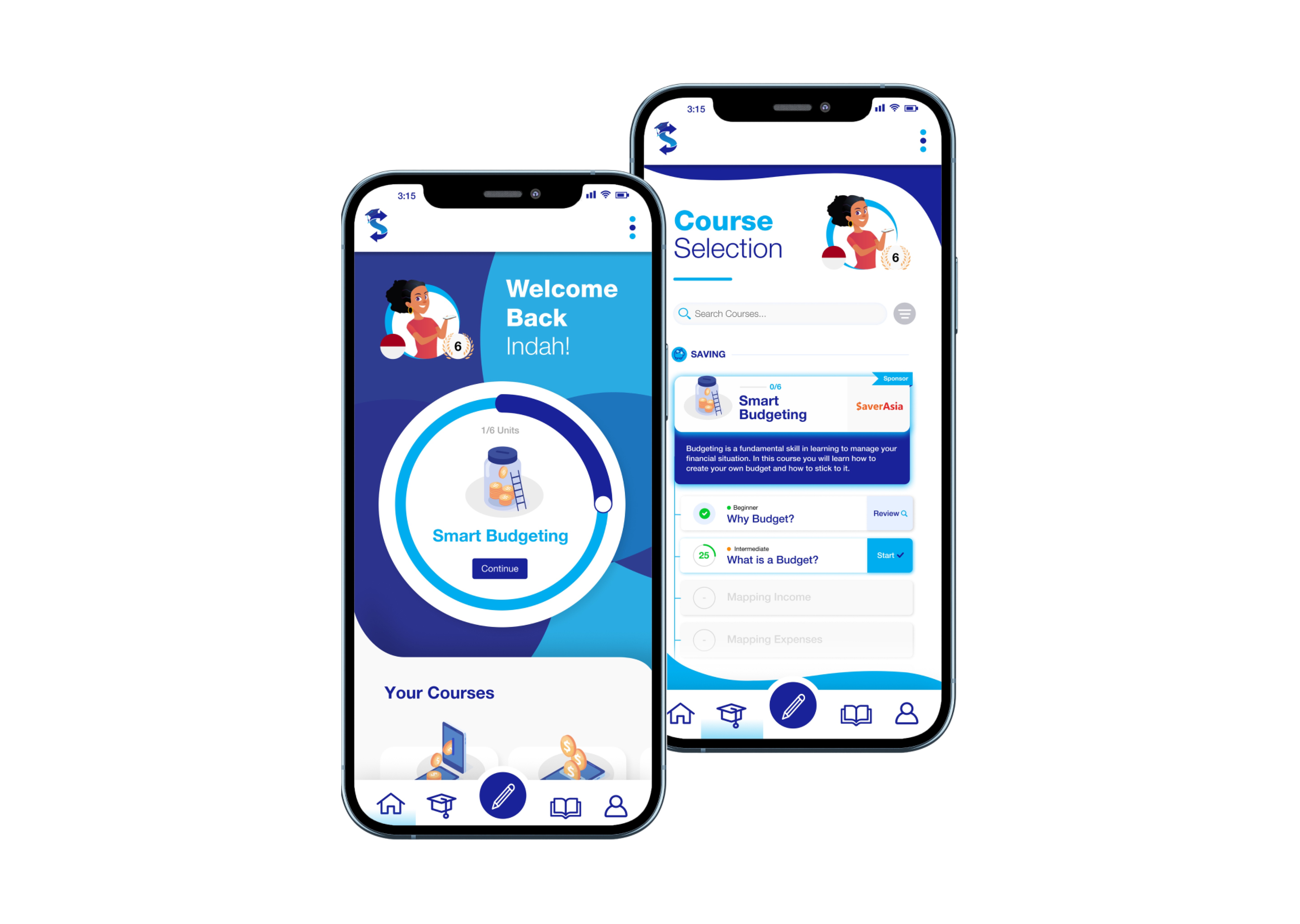

However, the opportunity provided by fintech’s for revolutionised banking and remittances are not fully realised due to current low financial literacy levels among this population. This technology, knowledge and communications gap in the industry is where SaverRemit Group (SRG) provides value to hundreds of millions of migrants, remittance operators, governments and migrant-focussed organisations.

SaverRemit has developed regional, migrant focused, online platforms that help migrant workers address this global problem by:

- Comparing the costs of sending remittances home by connecting with low-cost digital remittance providers.

- Financial empowerment through financial tools, resources and information.

SaverRemit addresses global problem with regional solutions through SaverAsia, SaverAfrica, SaverPacific, and SaverAmericas.

Choices made simpler

SaverRemit’s comparison service is leveraging the latest, transparent data from both fintech and traditional remittance providers using leading technology to help users perform objective comparison. The user interface has been tailored to and simplified for migrant workers, encouraging them to compare exchange rates to find the best deal. The filters allow migrants to customise their results, including choices to search by fee price, speed of transfer and method of transfer. Most importantly, the tool provides an explanation of these rates and fees. The comparison tool helps over 281 migrants across the world by communicating reliable information and highlighting the best deals, helping them simplify tough decisions so they can save money.

Tools for financial empowerment

By empowering the migrant community with financial tools, resources and information, SaverRemit enables the improvement of financial literacy levels across different regions throughout the globe. The budget calculator and Malaysian overtime calculator have been designed for the migrant community by SaverRemit in partnership with organisations and governments. These financial tools equip migrants with tangible solutions to use in planning their everyday lives.

SaverRemit have also developed supporting ‘How-to’ guides and information for migrants to confidently use these tools and access various financial services for the first time. The ‘Frequently Asked Questions’ and ‘Local Supports’ sections are available in all regional solutions, which educates migrants on financial concepts and connects them to additional resources that help with financial literacy, immigration affairs, and social organisations. By providing the tools and knowledge, SaverRemit effectively help migrants to make sense of difficult financial situations and make more informed decisions.

Transforming the remittance industry

As the remittance industry transforms, there is a great need from migrants to be equipped with the right tools and knowledge to fully maximise the opportunities for them to save money. A world first for integrated, transparent delivery of money transfer information and financial empowerment platform, SaverRemit is leading the way in empowering migrants to stay abreast of emerging remittance services and financial trends.

[1] UNIFAD, ‘International day of family remittances’.

[2] WorldBank, ‘Defying Predictions, Remittance Flows Remain Strong During COVID-19 Crisis’.

[3] Guthrie, J, 2021. ‘Lex in depth – remittance fintechs herald a payments revolution’, Financial Times, <https://www.ft.com/content/1f11b38b-54d6-451c-ba4b-48843efa329d>.

[4] Soper, T, 2021. ‘Remitly aims to raise up to $332m at $6.5bn valuation in IPO for Seattle fintech giant’, GeekWire, <https://www.geekwire.com/2021/remitly-aims-raise-294m-nearly-7b-valuation-ipo-seattle-fintech-giant/>.

[5] Gain, V, 2021. ‘WorldRemit Group, now called Zepz, valued at $5bn after latest funding’, Silicon Republic, <https://www.siliconrepublic.com/start-ups/worldremit-zepz-funding-investment-ipo>.

[6] Phua, R, 2021. ‘After $1m from EmergeVest, Lucy aims to be a fintech app for underbanked women’, Deal Street Asia, <https://www.dealstreetasia.com/stories/lucy-raises-1m-emergevest-255670/>.

Malorie Anne Manaois

Malorie uses her experience in developing financial literacy programs to innovate and build new resources that empower the users of SaverRemit platforms.