Empowering Migrants Through Financial Literacy: Insights from UNCDF Gender Colab Webinar

Eden Conway

Eden Conway

Empowering Migrants Through Financial Literacy: Insights from UNCDF Gender Colab Webinar

In a recent UNCDF Gender Colab webinar titled “Designing Gender-responsive Financial Literacy Programs: Empowering Migrants and Remittance Recipients,” our co-founder, Leon Isaacs, shared valuable insights and experiences from our work at Saver.Global and DMA Global. These insights are crucial in understanding the role of financial literacy in empowering migrants, particularly women.

Financial literacy is more than just understanding money; it’s about empowerment and equality, especially for migrants and remittance recipients. This is a crucial area where more attention and resources are needed. Our work at Saver.Global and DMA Global has been at the forefront of this, developing practical solutions to enhance financial literacy among these vulnerable groups.

One of our notable projects was in collaboration with the European Bank for Reconstruction and Development (EBRD) about ten years ago. This project was primarily focused on countries in the Commonwealth of Independent States (CIS), where remittances played a significant role. We observed that men often migrated for work, leaving women in charge of managing the finances back home. Our program targeted these women, offering them one-on-one financial training when they came to banks to collect remittances. This initiative led to nearly 120,000 people receiving financial education, opening of 20,000 bank accounts, and an impressive $20 million being moved from under mattresses into these accounts.

The key to the program’s success was our deep understanding of the trainees’ needs, building trust, and creating female-specific messaging. However, this approach was labor-intensive and costly, which brings us to the importance of digitalization in scaling such initiatives.

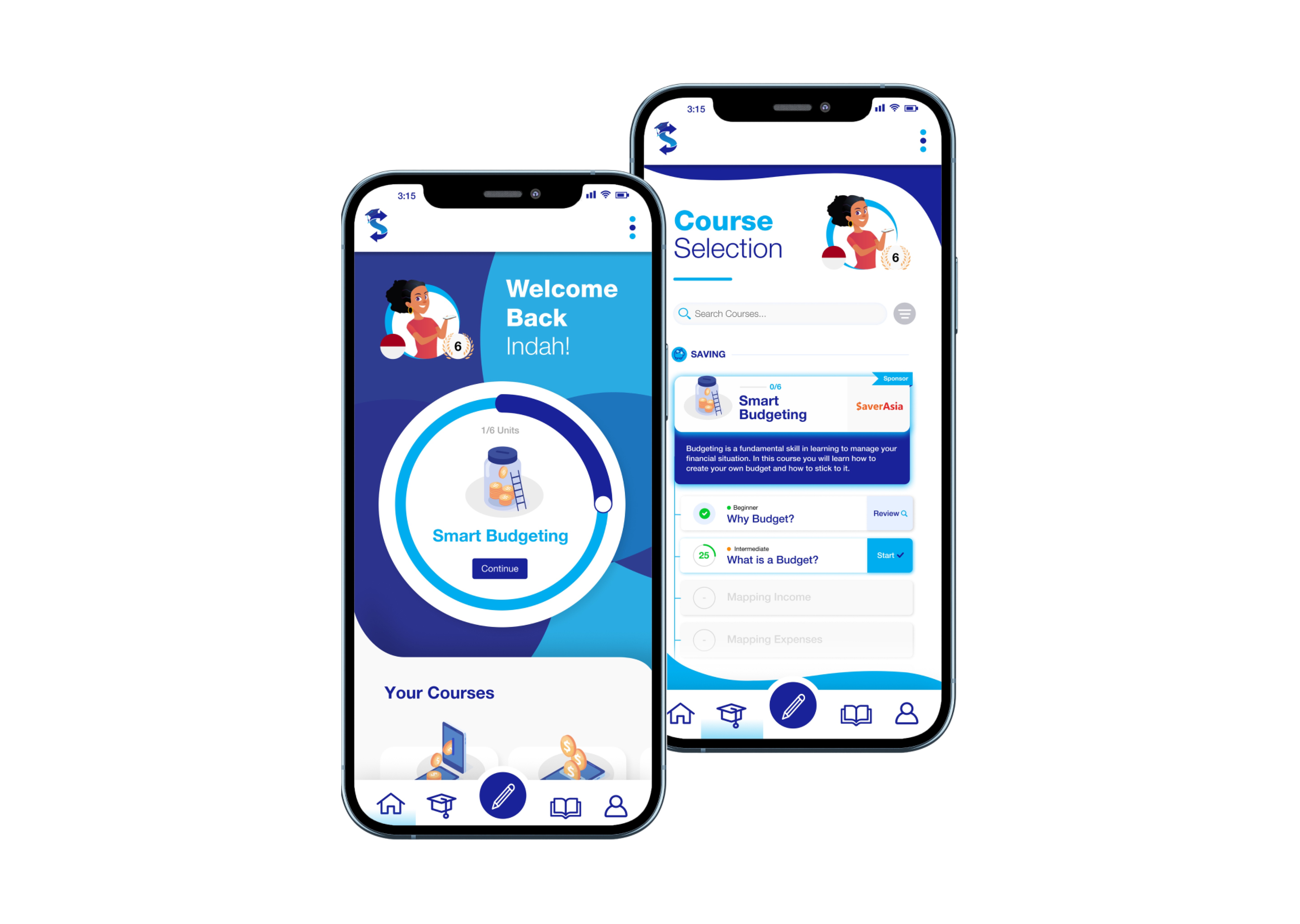

In 2018, we launched SaverAsia, a comprehensive digital platform designed to address the needs of migrant workers. This platform offers:

- Key financial guidance through its ‘Finance Basics’ section.

- Tools like budget and overtime calculators in the ‘Save Money’ section.

- Access to financial literacy courses and resources.

- Connections to local support organizations in host countries for migrant workers.

- A feature to compare remittance costs, covering 119 Money Transfer Operators across 69 corridors.

Leon Isaacs’ presentation underscored the importance of designing gender-responsive financial literacy programs. These initiatives not only empower migrants but also contribute significantly to their families’ and communities’ economic well-being. We invite you to watch the full webinar for a more comprehensive understanding of these vital issues. At Saver.Global, we remain committed to enhancing financial literacy and supporting women globally through innovative and impactful solutions.

Eden Conway

Eden brings both humanitarian and development experience into the Saver.Global strategy. He builds on our ability to revolutionise international development in his role as General Manager, Operations.