Empowering the Future: Bridging the Financial Knowledge Gap with SaverLearning

Saver.Global

Saver.Global

Empowering the Future: Bridging the Financial Knowledge Gap with SaverLearning

In today’s fast-paced, digitally driven world, financial literacy is a fundamental for individual and societal success. However, the lack of accessible financial education remains a significant obstacle. Financial knowledge is the key to making informed decisions about money, investments, and financial planning. However, traditional methods of financial education niche, costly, and boring! That is why we are launching SaverLearning – a gamified financial education platform.

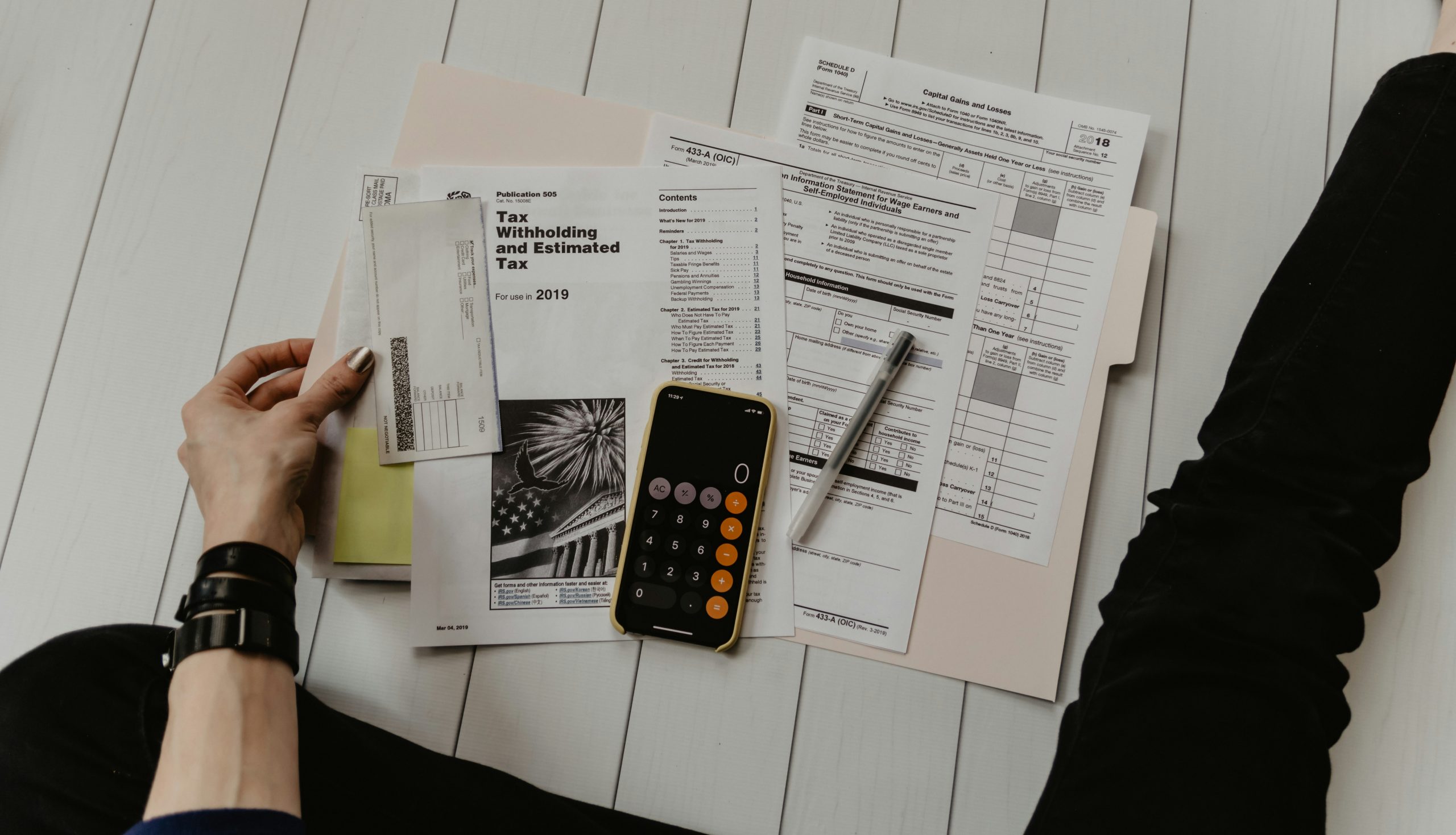

The Barriers to Financial Literacy

Many individuals face challenges in accessing comprehensive financial education. Whether due to financial constraints or limited availability of educational resources, these barriers can lead to uninformed financial decisions. For example, many people need to engage a financial advisor to learn more about their personal finance, and this comes with big fees which is inaccessible to some people. The consequences of this knowledge gap can be profound, affecting personal finances, opportunities for wealth creation, and ultimately, long-term financial security and skills.

The Power of Gamification in Financial Education

Gamification has shown tremendous potential in breaking down barriers to financial education. By incorporating elements of gaming into educational platforms, gamification transforms learning into an engaging and interactive experience. An analysis by PricewaterhouseCoopers (PwC) on “The Role of Gamification in Banking and Financial Services” revealed that financial institutions implementing gamification in their educational initiatives received positive feedback and higher satisfaction rates from their customers. Gamification made learning financial concepts enjoyable, resulting in increased interest and a sense of accomplishment. Through a playful and interactive interface, customers can explore complex financial concepts in a manner that is both enjoyable and easy.

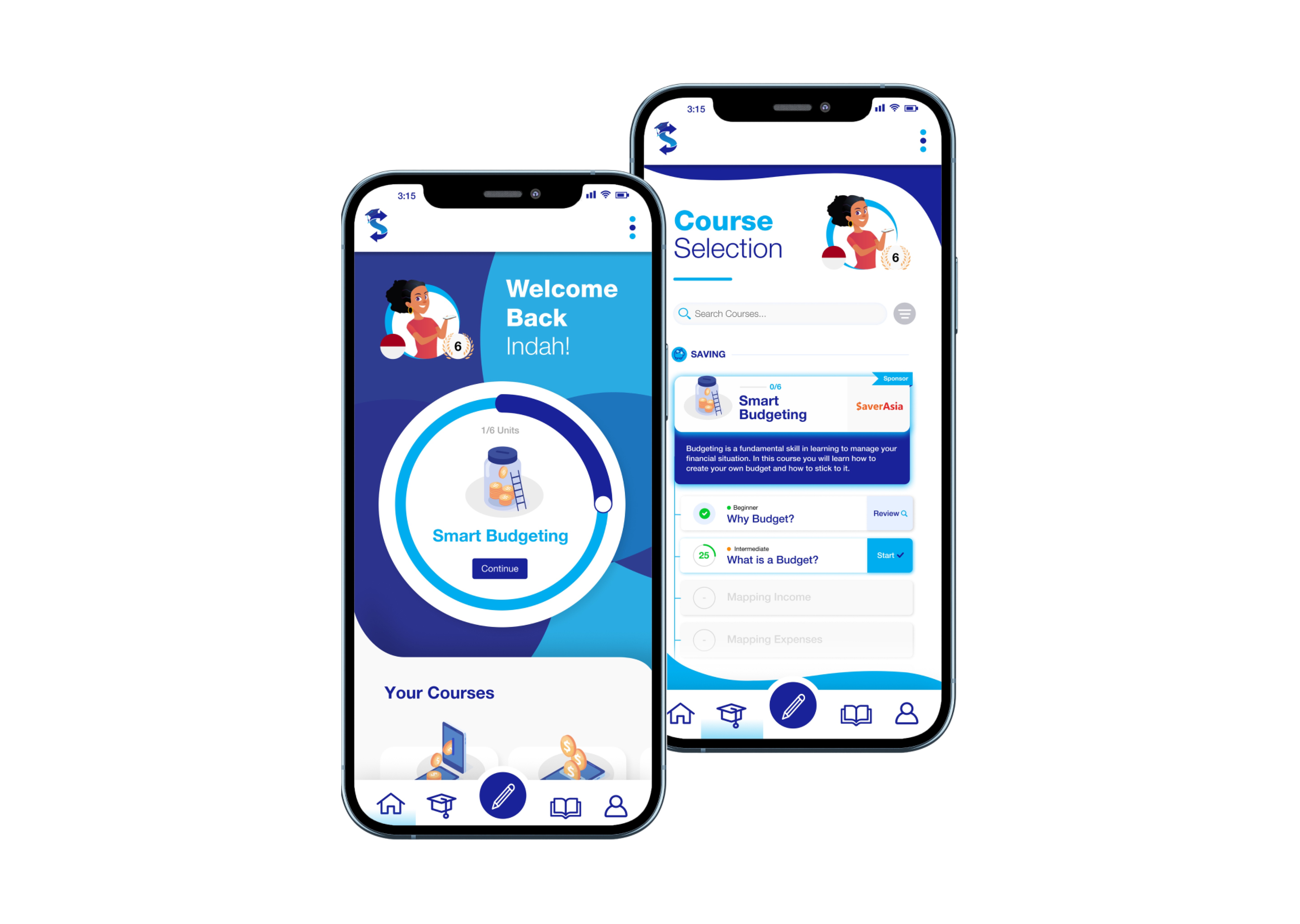

Introducing SaverLearning: The Digital Financial Education Products

Gamification promotes a hands-on learning approach. Instead of passively consuming information, users actively engage with the content, making decisions and witnessing the consequences in a safe virtual environment. This interactive learning style encourages critical thinking, problem-solving, and risk assessment – all essential skills for managing personal finances effectively.

SaverLearning incorporates various game mechanics, such as challenges, quizzes, and rewards, to incentivize users. These elements foster healthy competition and a sense of community, encouraging users to share their progress and learn from one another such as friends and family on social media to create a social media community and accountability. Under this circumstance, users can apply what they learn to better understand how to manage their finances.

Making Financial Learning Accessible and Inclusive

Accessibility is a crucial aspect of SaverLearning. By offering a mobile-friendly platform, it ensures that individuals can access financial education anytime, anywhere, using their smartphones or tablets. This inclusivity democratizes learning, enabling a broader audience to overcome financial barriers and equip themselves with the necessary knowledge to secure their financial futures.

Fostering Financial Empowerment and Independence

Empowerment is at the heart of SaverLearning. For migrants, SaverLearning offers a platform where they can learn about the financial landscape of their new environment in an interactive and enjoyable manner. The gamified approach breaks down cultural and linguistic barriers, ensuring that financial concepts are presented in a universal language that transcends borders. This inclusivity empowers migrants to familiarize themselves with financial systems, services, and terminologies specific to their home country, enabling them to make informed decisions and actively participate in the financial activities overseas. This encourages our users to take control of their financial futures, fostering a sense of financial empowerment and independence.

A Vision for the Future: Equipping All for Financial Success

In envisioning a brighter future, we see a world where financial education is readily available and easily accessible to all. SaverLearning plays a vital role in this vision, breaking barriers and enabling individuals to unlock their financial potential. By bridging the financial knowledge gap and empowering individuals to make informed choices, we pave the way towards a society where financial success is within reach for everyone.

Visit our registration page to learn more and register for a preview of SaverLearning!

Please follow our journey on LinkedIn and look out for our launch coming very soon!