Unravelling the Importance of Data in Today’s Interconnected World

Vibhor Jain

Vibhor Jain

The future of remittance industry analytics with Saver.Global

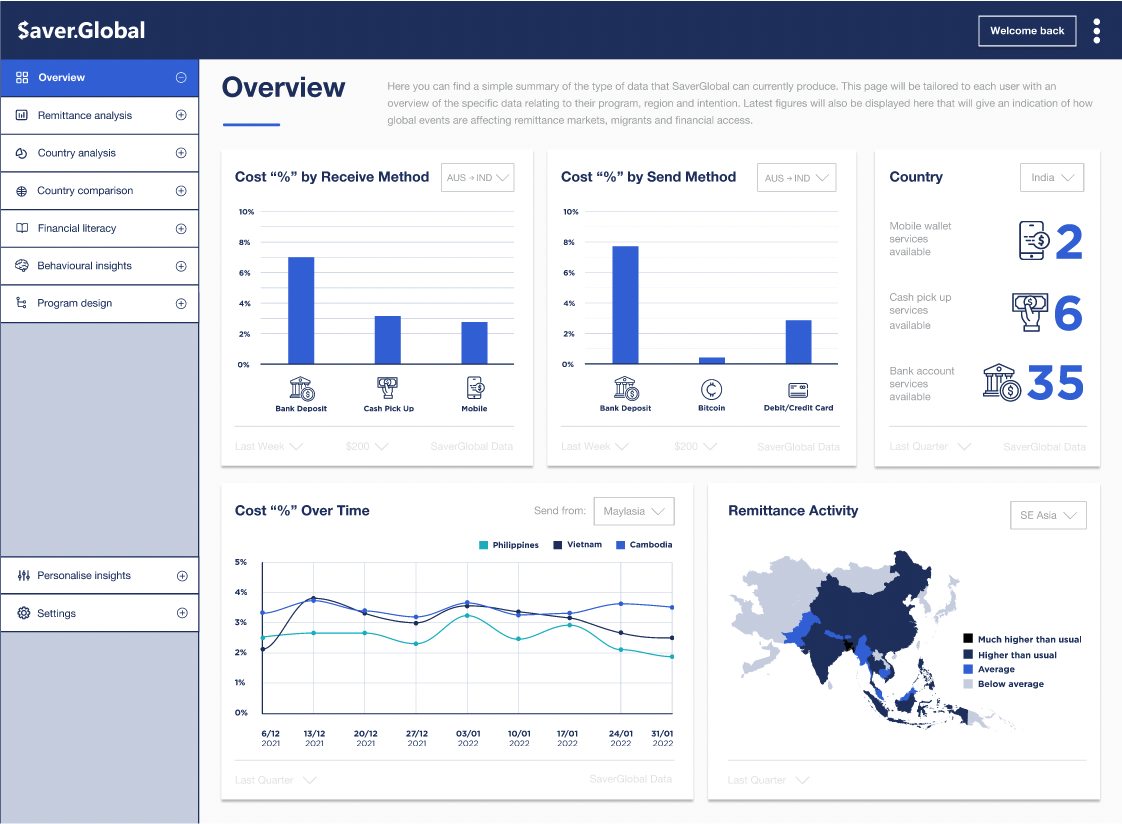

In today’s digitally driven age, data has become the lifeblood of businesses and organizations across the globe. The sheer volume, velocity, and variety of data generated daily are staggering, presenting both opportunities and challenges. This data, when properly analyzed and harnessed, holds the power to uncover valuable insights, drive innovation, and shape strategic decision-making. This blog will delve into the crucial role of data in today’s landscape, exploring trends in data analytics, privacy concerns, and highlighting how businesses can effectively utilize data for strategic decision-making along with the value that Saver.Global’s analytics-based approach via its data portal, insights and tools brings in these areas to the remittance industry and its players.

The Rise of Data Analytics:

With the exponential growth of digital platforms, companies have access to an unprecedented amount of data, hence data analytics has emerged as a game-changer in recent years. From customer behavior analysis to predictive modeling, data analytics empowers companies to make informed decisions and gain a competitive edge, optimize operations, and enhance customer experiences.

Uncovering Actionable Insights

Data analytics enables businesses to uncover actionable insights that were previously hidden or difficult to identify. Advanced analytics tools and techniques, including machine learning and artificial intelligence, help analyze vast amounts of data through which organizations can identify trends, patterns, and correlations that can drive strategic decision-making. For example, a remittance company can analyze customer transaction behavior to understand their preferences, optimize cost as well as enhance send and receive methods, and personalize marketing campaigns. This has been one of the major insights that the Saver.Global portal uses to understand the customer behavior in the type of remittance service providers they are choosing to send money with, and then enhancing the customer experience by providing more service provider options so that the customer can make an informed best choice.

Real-time Analytics and Decision Making

The demand for real-time insights is a driving force behind the evolution of data analytics. With the advent of technologies like the Internet of Things (IoT), businesses can capture and analyze data in real time. In addition, the availability of real-time data has revolutionized decision-making processes. This capability is invaluable in sectors such as finance where timely decisions can have a significant impact. Businesses can now access up-to-the-minute information, allowing them to make quick and informed decisions. Real-time analytics enhances agility and responsiveness, enabling organizations to adapt swiftly to changing market conditions, customer demands, and emerging trends. For example, the usage of APIs for providing more and more real-time based remittance information for customers to complete a money transfer has allowed service providers to not only provide minute to minute cost comparison with other service providers, but has also allowed them to fortify their market position over such players who still provide over the counter rates. Also, this shift to real-time data has not only allowed service providers to enhance the customer experience by providing more and more digital services, but has also allowed service providers to use this online data to perform real-time analytics and use the insights to make better business decisions as well.

Enhanced Customer Experiences

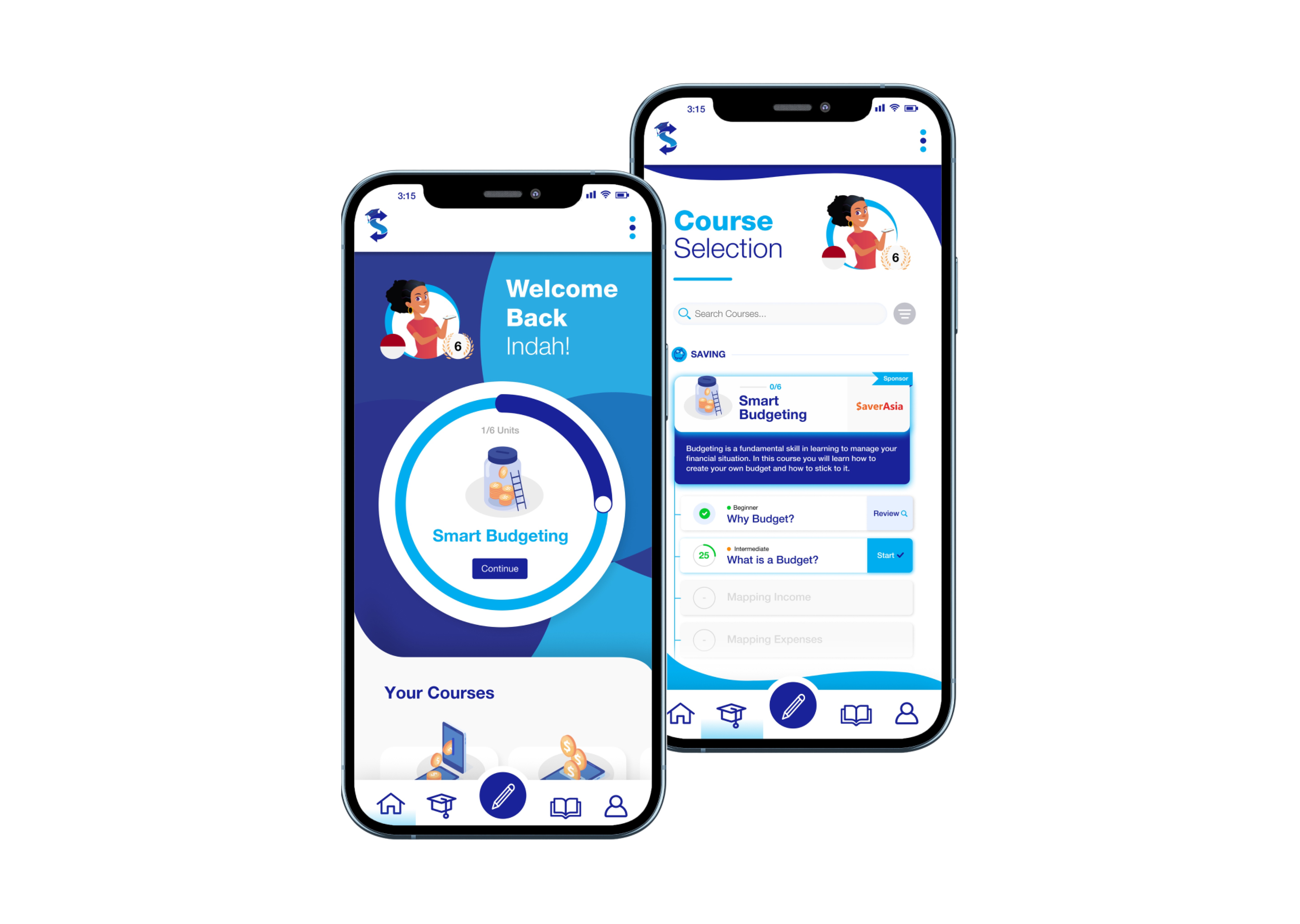

Data analytics plays a pivotal role in enhancing customer experiences. By analyzing customer data, businesses can gain a deeper understanding of their preferences, behaviors, and needs. This knowledge enables companies to deliver personalized recommendations, targeted marketing campaigns, and tailored customer experiences. For instance, many remittance service providers try to leverage user data to offer better money transfer options and suggestions, resulting in increased customer engagement and loyalty. Saver.Global addresses this need by providing the required valuable insights as well as offering financial literacy (recently introduced) to enhance their overall customer experience. For example, Saver.Global’s SaverLearning platform has been designed to not only help organizations enhance their financial education initiatives by providing tailored, data-driven courses and insights that promote financial literacy and long-term sustainable impact, but also help individuals by empowering them with the practical knowledge and support for a lifetime of financial wellbeing through the personalized financial literacy courses, thereby allowing two way enhancement of the customer experience.

Privacy Concerns in the Data Age:

While the benefits of data are undeniable, the increasing reliance on it raises privacy concerns. The collection and processing of personal information have sparked debates about data ownership, consent, and the ethical use of information. High-profile data breaches and the misuse of personal data have heightened public awareness and prompted regulatory responses, such as the General Data Protection Regulation (GDPR) in Europe. Balancing the benefits of data analytics with the need for robust privacy protections is a critical challenge for businesses in today’s interconnected world and is essential to maintain consumer trust and loyalty.

Ethical Considerations

As businesses navigate the data landscape, ethical considerations come to the forefront. Responsible data use involves transparent practices, ensuring that individuals are aware of how their data is being used and protected. Businesses must establish ethical frameworks for data collection, storage, and analysis, addressing issues such as bias in algorithms and the potential societal impacts of their data-driven decisions.

Harnessing Data for Strategic Decision-Making:

Strategic decision-making in today’s business environment requires a data-driven approach. Companies can harness data to gain a deeper understanding of their customers, optimize operations, and identify new opportunities. By leveraging predictive analytics, organizations can anticipate market trends and make proactive decisions. Data-driven decision-making is not limited to large corporations; even small and medium-sized enterprises can benefit by adopting scalable analytics solutions. Saver.Global has been striving hard to make sure that service providers in the remittance industry are always abreast with up-to-date market trends and customer behavior pattern through effective and efficient utilization of available data. And this is where our SaverLearning platform can make an impact in the following ways for service providers to help them make a strong data driven strategic decisions:

- Enhanced Financial Education Impact: Partnering with SaverLearning allows service providers to deliver customer centric personalized financial education which will maximize the effectiveness of their programs.

- Data-Driven Insights: Leveraging SaverLearning’s comprehensive monitoring and evaluation dashboard to measure user engagement and learning outcomes, which will enable service providers to make data-driven improvements and decisions.

- Attain Cost-Efficiency: SaverLearning’s scalable infrastructure ensures cost-effective deployment, making financial education accessible to a broader audience. Thus, ensuring more accuracy to its data insights by studying a larger sample size.

- Allow Sustained Engagement: SaverLearning platform allows service providers to not only build long-term relationships with their audience but also allows them to promote continuous financial literacy and ongoing informed decision making.

Conclusion

In conclusion, data has become an indispensable asset in today’s interconnected world. Data analytics has become a cornerstone of decision-making, enabling organizations to thrive in a rapidly evolving landscape. However, businesses must navigate the ethical and privacy considerations associated with the use of data. By embracing responsible practices and leveraging data strategically, businesses can unlock the full potential of data and gain a competitive advantage in today’s digital landscape.

If you would like to know more about the Saver.Global’s data insights or SaverLearning program, then do reach out us at info@saver.global.

Sources:

[1] Source: “Building a Culture of Data Integrity in Your Organization” – Available at: https://www.researchgate.net/publication/375039410_Building_a_Culture_of_Data_Integrity_in_Your_Organization

[2] Source: “How Data Analytics Can Improve Decision-Making” – Available at: https://community.microstrategy.com/s/article/How-Data-Analytics-Can-Improve-Decision-Making?language=en_US